Florida Discretionary Sales Surtax 2025

Florida Discretionary Sales Surtax 2025. A business located in a county with a 1 percent (1%) discretionary sales surtax rate sells a single taxable item for. Florida tax law authorizes the counties of florida to levy various types of local option taxes, including a discretionary sales surtax, provided that the sales amount.

The 1% sales surtax, on top of the 6% state sales tax, will fund investments in capital improvement projects for the county, school board and. A business located in a county with a 1 percent (1%) discretionary sales surtax rate sells a single taxable item for.

A business located in a county with a 1 percent (1%) discretionary sales surtax rate sells a single taxable item for.

Florida’s discretionary sales surtax system adds complexity to the state’s sales tax environment.

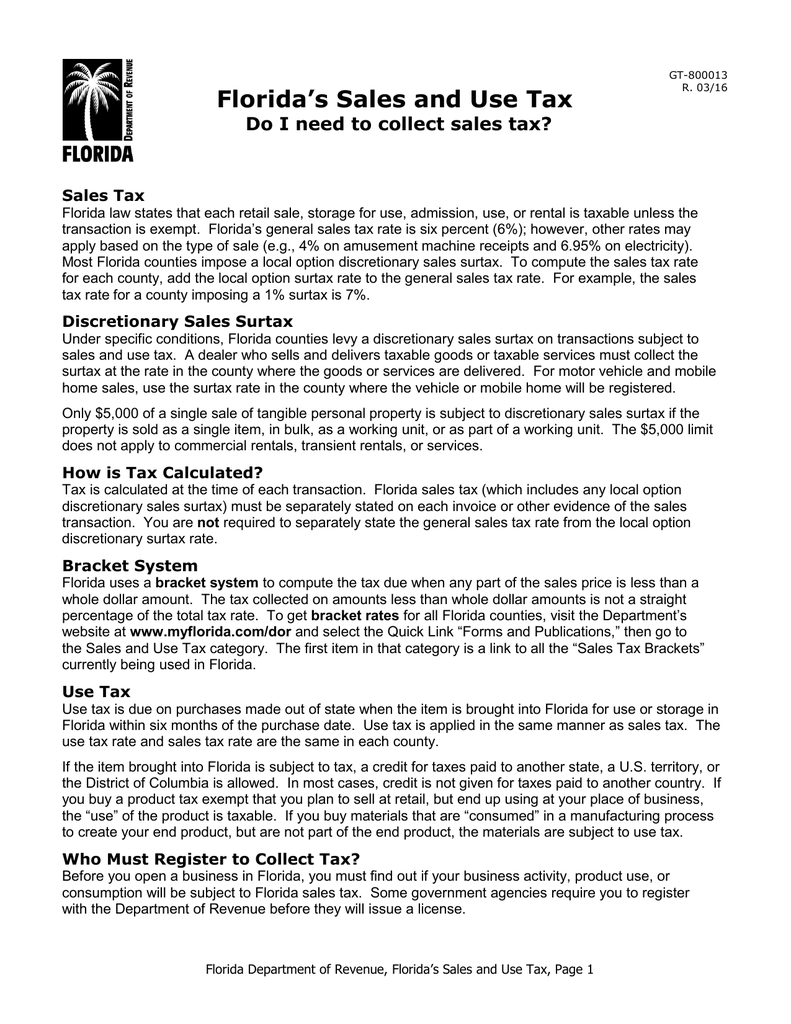

Update Business Rent Tax and the Discretionary Sales Tax The Legal, 212.055 shall be a discretionary surtax on all transactions occurring in the county. Many florida counties have a discretionary sales surtax (county tax) that applies to most transactions subject to the sales or use tax.

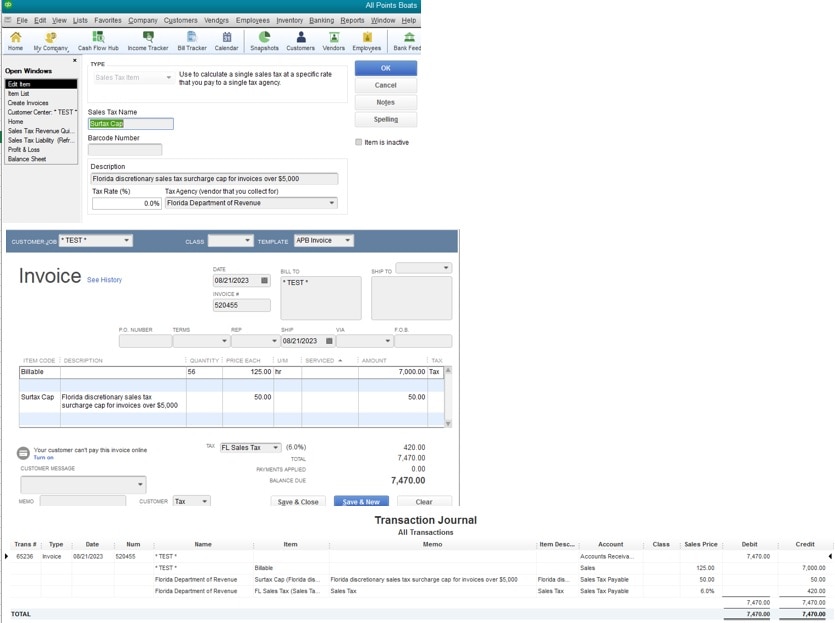

Are you able to set up discretionary sales tax by county in Florida, Construction contractors who repair, alter, improve, and construct real property; How to calculate, collect, and report your discretionary sales surtax.

Florida`s Sales and Use Tax Florida Department of Revenue, The 1% sales surtax, on top of the 6% state sales tax, will fund investments in capital improvement projects for the county, school board and. This table provides current discretionary sales surtax (dss) information for all jurisdictions within the state.

Florida Annual Resale Certificate PDF Form FormsPal, This table provides current discretionary sales surtax (dss) information for all jurisdictions within the state. Sales tax dealers must collect both discretionary sales surtax and the state sales tax from the purchaser at the time of sale, and remit the taxes to the florida department of revenue.

Request for Proposal (RFP Discretionary) Florida Doc Template, Florida discretionary sales surtax a discretionary sales surtax, or a county tax, is a transactional tax, like sales or use taxes. Construction contractors who repair, alter, improve, and construct real property;

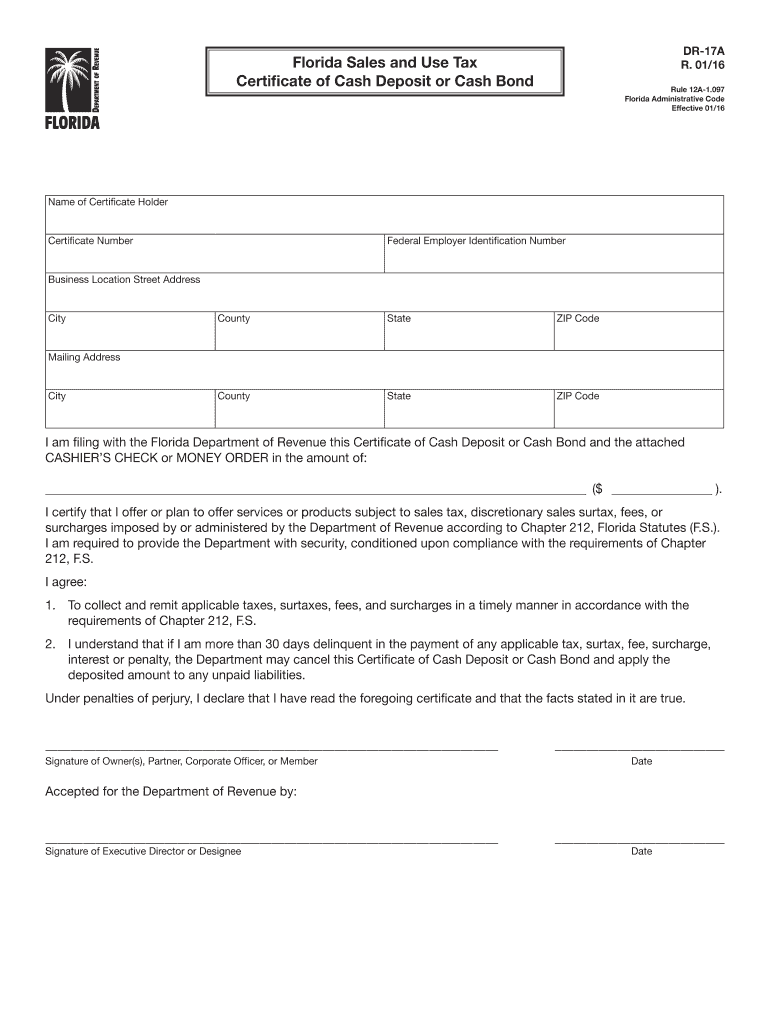

Florida Sales Deposit 20162024 Form Fill Out and Sign Printable PDF, A business located in a county with a discretionary sales surtax sells a single taxable item for $6,500. How to calculate, collect, and report your discretionary sales surtax.

Florida Sales Tax TipTuesday 3/3/2025 Business to Business Bookkeeping, The florida department of revenue. You can view or download and save all information.

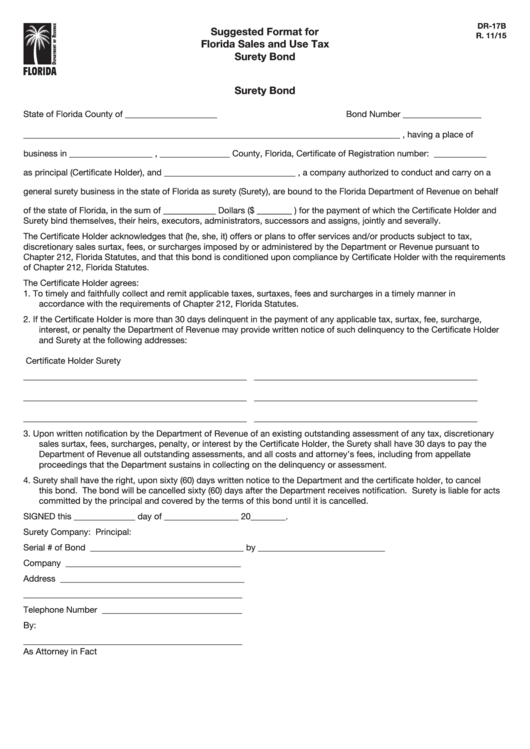

Suggested Format For Florida Sales And Use Tax Surety Bond printable, A business located in a county with a discretionary sales surtax sells a single taxable item for $6,500. Discretionary sales surtax collected must be included in column 4.

Are you able to set up discretionary sales tax by county in Florida, How to calculate, collect, and report your discretionary sales surtax. Sales tax dealers must collect both discretionary sales surtax and the state sales tax from the purchaser at the time of sale, and remit the taxes to the florida department of revenue.

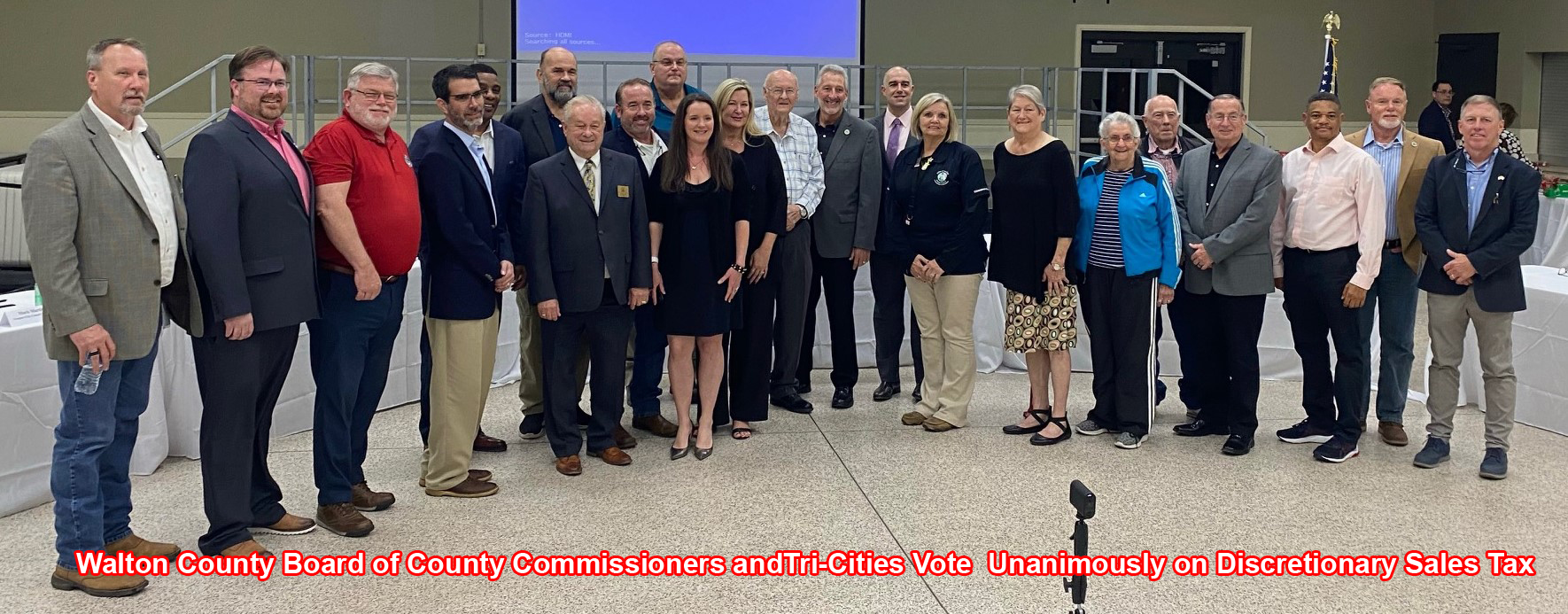

30a TV Beaches of South Walton Florida News Walton County BCC Vote, Discretionary sales surtax, also called a county tax, is imposed by most florida counties and applies to most transactions subject to sales tax. Starting june 1, 2025, the state sales tax rate applied to commercial rentals under section 212.031, florida statutes (f.s.), is set to decrease significantly from 4.5.

The florida department of revenue (dor) june 19 published information on the discretionary sales surtax on sales of boats and trailers, effective july 1.