2025 Gift Tax Exclusion 2025

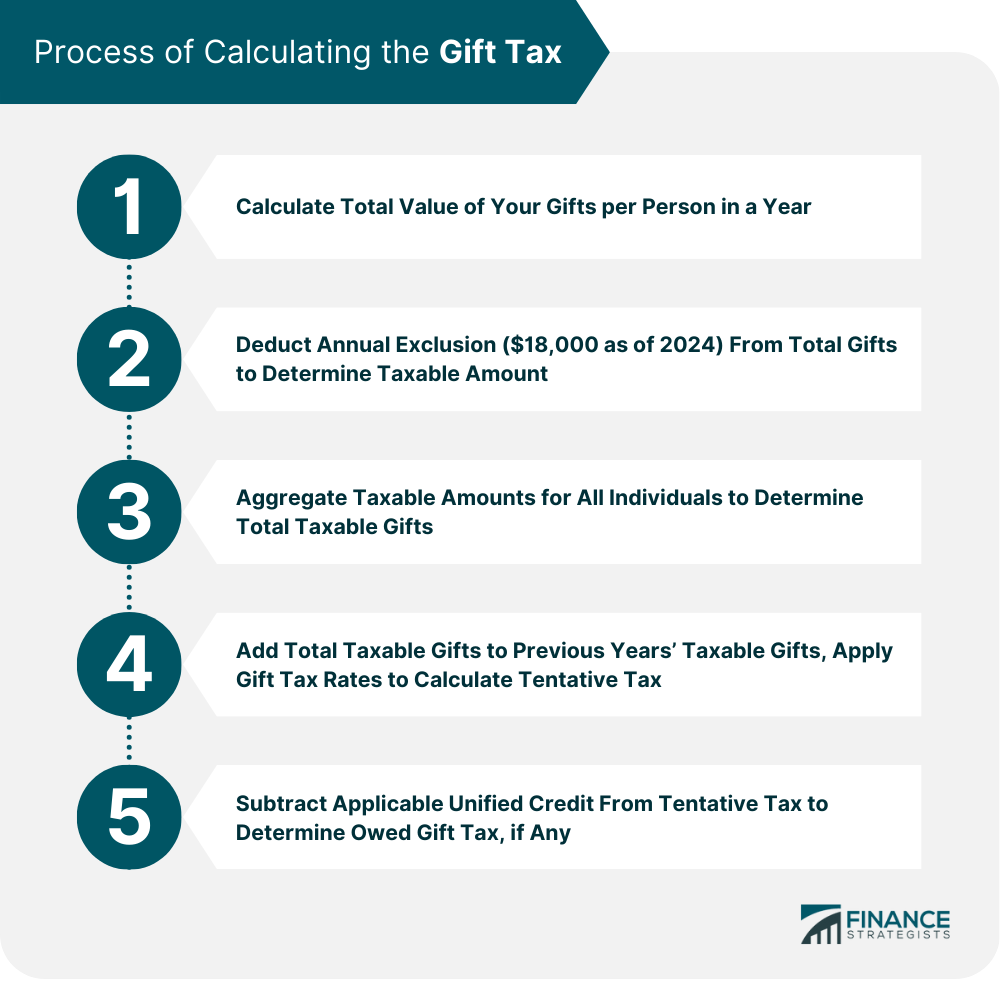

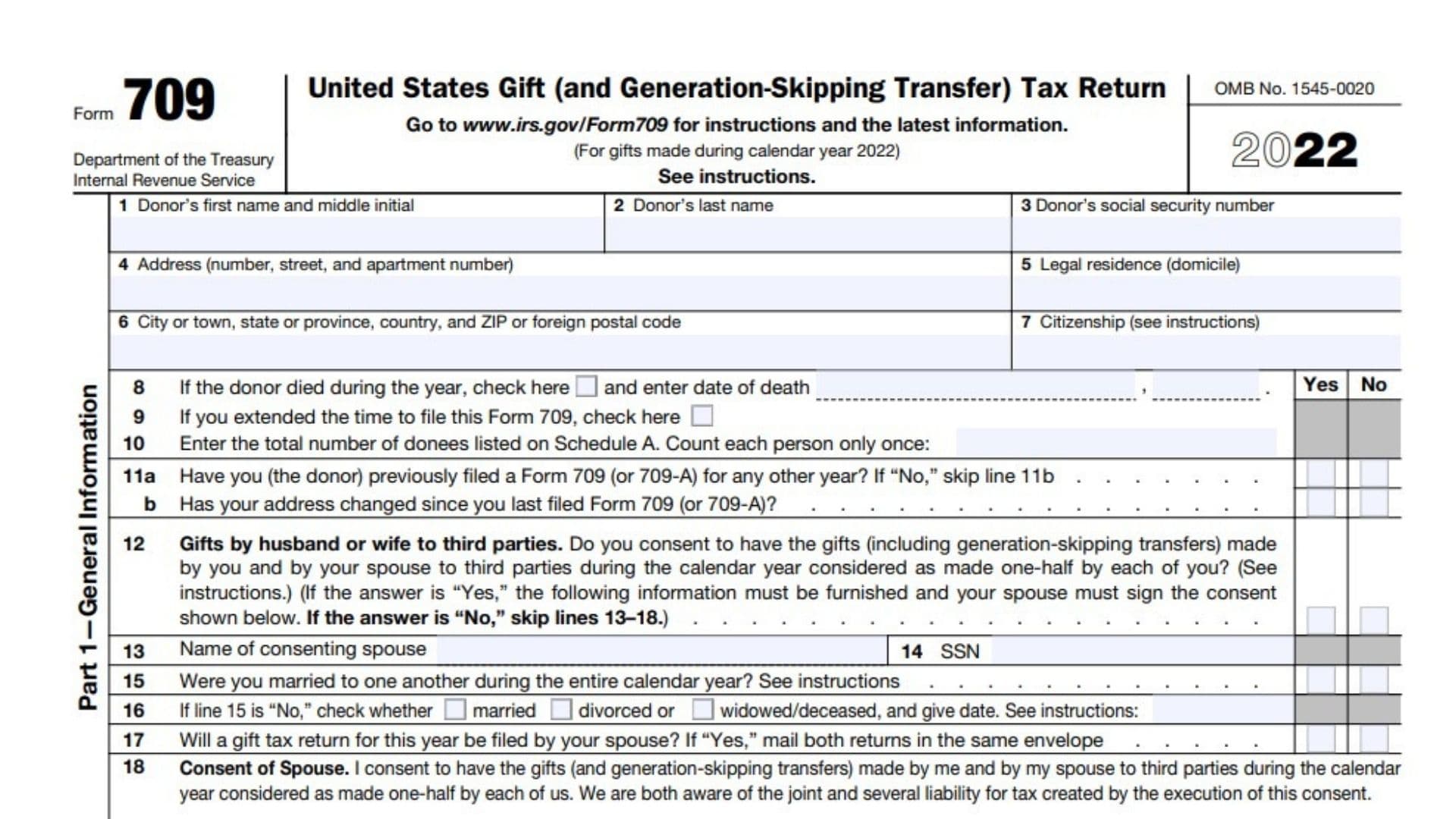

2025 Gift Tax Exclusion 2025. This allows individuals to gift up to $19,000. As of january 1, 2025, the federal gift tax annual exclusion amount has increased to $19,000 per donee per donor (or a combined $38,000 per donee for a married couple).

The annual exclusion for gifts is increased to $19,000 for the 2025 calendar year, up from $18,000 in 2025. The sunsetting of the gift tax exclusion in 2025 marks a significant shift in the estate planning landscape, particularly for real estate assets.

2025 Gift Tax Exclusion Annual Lita Sherri, The sunsetting of the gift tax exclusion in 2025 marks a significant shift in the estate planning landscape, particularly for real estate assets.

What Is The Gift Tax Limit For 2025 And 2025 Myrle Vallie, With this change, in 2025, an individual may gift up to $19,000 to an unlimited number of recipients without federal gift tax consequences (meaning the gifts do not consume.

Gift Tax Exemption 2025 Understanding The Lifetime Exclusion And Its, This gift tax annual exclusion was indexed.

Gift Tax Exemption 2025 Understanding The Lifetime Exclusion And Its, The irs has revealed that, starting in 2025, inflation adjustments will bring significant increases to the annual gift tax exclusion and the lifetime estate and gift tax.

2025 Gift Exclusions Windows Manon Rubetta, The sunsetting of the gift tax exclusion in 2025 marks a significant shift in the estate planning landscape, particularly for real estate assets.

Understanding The Gift Tax Exemption A Comprehensive Guide To The 2025, Starting january 1, 2025, the federal lifetime gift, estate, and gst tax exemption amount will increase to $13,990,000 per person or $27,980,000 for a married couple.

Gift Tax Exclusion Change After 2025 Tiff Adelina, Starting january 1, 2025, the annual gift tax exclusion will increase to $19,000 per recipient, up from $18,000 in 2025.

What Is The Gift Tax Limit For 2025 And 2025 Myrle Vallie, The irs has revealed that, starting in 2025, inflation adjustments will bring significant increases to the annual gift tax exclusion and the lifetime estate and gift tax.

Irs Annual Gift Tax Exclusion 2025 Livia Queenie, Taxpayers and businesses are eagerly awaiting the union budget 2025, with expectations for reforms including increased capex, higher tax exemptions, streamlined tax.

2025 Gift Tax Exclusion Annual Lita Sherri, As of january 1, 2025, the federal gift tax annual exclusion amount has increased to $19,000 per donee per donor (or a combined $38,000 per donee for a married couple).

January 2025 Calendar Images Free Download Gif. Are you searching for calendar 2025 january png hd images or vector? Choose from hd to 4k resolution images compatible with your desktop

Full Moon And New Moon February 2025. When is the next full moon? Times of the full moon, new moon, and every phase in between. March and september will each

Games Coming In 2026 Pc. Ragebound is on the way from the minds of tmnt: The year’s biggest new releases, besides gta 6 and switch 2. It’s coming to pc,